Trade Idea:

Exterran Holdings (EXH) $355m 4.25% converts due 6/15/14 trade at 107.75 vs. 18 for 3.9% current yield and 38.6% premium. Using 500 credit spread, the implied vol. is 38 and delta is 55. This seems cheap given the historical realized vol. of over 50. The credit also has potential for tightening as we get closer to maturity.

On 8/7/12, EXH announced that its Venezuela subsidiary completed the sale of assets nationalized in 2009 to PDVSA Gas for a total consideration of $442m ($177m initial payment and $265m in periodic payments through 3Q 2016). Proceeds will be used to repay $50m of previously collected insurance money with the remainder to reduce debt and for general corporate purposes. This development significantly improves EXH’s credit profile, particularly for the two convertible bond issues due in 2014, the next maturing debts ($144m 4.75% converts due 01/2014 and $355m 4.25% converts due 06/2014).

Following the news, EXH stock was up 17% to $18.21. The converts were up about 1 point on a 48 delta. The 7.5% straight bonds of 2018 traded up 2 points with the spread tightening from 570 to 512. Even prior to this news, EXH was in the process of delivering, with Debt/EBITDA declining from 4.3x to 3.7x in the last 6 months.

EXH is highly leveraged to the natural gas market, particularly production volumes. While the natural gas market in North America remains challenged, the international natural markets remain robust (about 30% of profits). The company generated about $400m of EBITDA in the last 12 months with expectations of $530m in 2013. In the bull case scenario, EXH can trade at 5x 203 EBTIDA of $580m for an implied stock price of $25. In the bear case, EXH can trade at 4x 2013 EBTIDA of $320m for an implied stock price of $8.

Company profile

EXH is the largest compression services company in the US with about 50% market share. The company packages compression equipment from suppliers, which is then leased or sold to the natural gas E&P operators. The company assembles a compressor (Ariel or Dresser-Rand), engine (Waukesha or Caterpillar), and a cooling system onto a truck mountable skid for easy transportation. Roughly 30-35% of onshore US operators outsource compression services. Larger E&Ps (such as CHK) are more likely to use their own compressor equipment.

EXH does not manufacture compressors but instead assembles these components into a compressor package. The company adds little value in the assembly process but does add value (which E&P’s are willing to pay for) through services to reduce downtime and logistics. Services provided include designing, sourcing, owning, installing, operating, servicing, repairing and maintaining compressor equipment. Advantages to using EXH services: 1) Upgrade/downgrade equipment with other EXH customers, 2) Better equipment service, 3) less capital required.

Contracts are fee based over several years, which EXH then either keeps them on its books (about 50% of horsepower) or sells to its majority owned MLP (Exterran Partners).

Compression equipment is used in several natural gas production applications including: 1) at the well head (field compression), 2) through gathering systems (field compression), and 3) along long-haul pipelines.

As natural gas wells mature, production levels naturally decline as reservoir pressures fall. Once pressures fall below a certain level, field compression is needed for boosting onto the gathering system. But even with compression, production will continue to decline and will require steadily increasing compression levels to maintain production.

Compressor leasing revenue roughly tracks total gas production. However, in 2008, natural gas producers ordered extra compression equipment at the top of the market, thus creating an overhang for the entire market. Unconventional shale plays need compression equipment later in its life cycle than conventional sources thus pushing out demand even further.

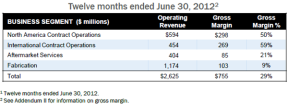

EXH gets revenues from 3 segments:

Contract compression (41% revenues, 70% gross profit) – 42% of the gross profit is from North America and 28% is from international (Latin America, Middle East, Indonesia)

Fabrication (48% revenues, 23% gross profit) – equipment sales that are not part of the contract compression leasing business. This includes assembling compressor systems as well as more complicated equipment for refineries and petrochemical plants.

Aftermarket (11% revenue, 7% gross profit) – after market services provide support services for compression systems.

MLP model

In this structure, the MLP (Exterran Partners) purchases assets from Exterran holdings and distributes all available cash earnings from those assets to investors in the MLP quarterly. Currently, the dividend yield on Exterran Partners (EXLP) is 8.9% assuming a constant .5025 quarterly distribution.

Exterran plans to use the MLP as a vehicle to sell the slower growing North American contract compression business and invest the proceeds in the faster growing International business. Selling the assets to the MLP is ideal because of the arbitrage created through the sale as EXLP typically trades at a higher multiple than EXH, mostly due to the favorable tax treatment of the partnership structure and a lower cost of capital. The partnership will most likely have the opportunity to purchase the remaining portion of the US contract operations in the coming future. Exterran Holdings (EXH) has historically transferred about 250,000 horsepower to Exterran Partners (EXLP) a year so at that rate the entire North American contract compressor business would be transferred to EXLP in about 10 years. The public owns 70% and EXH owns 30% of EXLP.

The partnership buys customer relationships and all equipment and service deals with that customer. The recent 8/12/2010 transaction included the drop-down of 43 customers and 580 compressor units, representing about 255k HP. The partnership buys assets from Exterran (EXH) by issuing shareholder units to the company, assuming EXH debt, or paying cash. Typically units are issued, which the company can sell in the open market at a later date to raise capital. The sale price of the assets is treated as an arm’s length transaction and monitored by the conflict of interests committee (three independent board members). This becomes more important as more of the partnership shares are owned by the public.

Credit

I feel that using 500 credit spread for the 4.25% convertible bonds is appropriate given that the convert has less than 2 years remaining. The 7.5% straight bond (higher rank due to sub guarantees) due 2018 trades at 550 spread. The company is rated B+/Ba2.

Although EXLP is only 30% owned, its financials are consolidated into EXP when presented.

Cash = $21m (6/30/12), 30% Ownership of EXLP = $319m

Total debt = $1.68B (EXH stand-alone = $1.079B) PF 06/30/12 for Venezuela asset sale

4.75% convertible bonds due 1/2014 = $144m (no sub guarantee)

4.25% convertible bonds due 6/2014 = $355m (no sub guarantee)

EXLP Revolver due 2015 = $493m drawn ($57m available)

EXLP Term loan due 2015 = $150m

Revolver due 2016 = $250m drawn ($670m available)

7.25% senior notes due 2018 = $350m (guaranteed by subs)

LTM EBITDA = $402m (stand-alone = $320m)

Debt /EBITDA = 4.6x (stand alone and covenant purposes = 3.3x)

EBITDA/Interest expense = 2.6x (stand alone and covenant purposes = 4.0x)

Secured debt/EBITDA = 1.2x

Market cap = $1.2B

Covenants:

Debt/EBTIDA < 5.0x

EBITDA/Interest expense > 2.25x

Secured debt/EBITDA < 4.0x

The 4.75% converts were originally issued by Hanover Compressor and were considered structurally senior to the 4.25% converts which were issued by the holding company. However in 2Q12, the 4.75% converts were assigned to the holding company in a corporate restructuring that eliminated Hanover Compressor. Currently, the two converts are considered pari passu.

Cash flow

EXH is a consistent cash flow generator. Capex can fluctuate and should be offset by equipment sales and sales to EXLP since much of the capex is used for contracts sold to EXLP.

| LTM |

2011 |

2010 |

2009 |

2008 |

2007 |

|

| CFFO |

179 |

120 |

364 |

477 |

486 |

239 |

| Capex |

-403 |

-282 |

-235 |

-368 |

-466 |

-352 |

| Equipment sales |

40 |

46 |

31 |

69 |

56 |

36 |

| Sales to EXLP |

184 |

223 |

214 |

|||

| FCF |

0 |

107 |

374 |

178 |

76 |

-77 |

Stock reaction on earnings

| earnings date | stock reaction |

|

8/2/2012 |

2.5% |

|

5/3/2012 |

-0.2% |

|

2/23/2012 |

19.2% |

|

11/3/2011 |

20.7% |

|

8/4/2011 |

-20.0% |

|

5/5/2011 |

-1.4% |

|

2/24/2011 |

-4.0% |

4.25% Converts specifics:

Lose 4 points on a $25 takeout using 55 delta. I don’t think a takeout is likely since EXH is the market leader and there isn’t a larger natural buyer.

Dividend protected from zero.

Get last coupon before maturity if converting.