There are two types of covenants:

- Affirmative covenants

- Negative covenants

Affirmative covenants state what the borrower must do. Negative covenants state what the borrower may not do. Negative covenants usually include financial covenants that state the issuer cannot have a leverage ratio above a set limit or an interest coverage ratio below a set limit.

Many credit agreements or indentures create a separate section or article for each category but frequently financial covenants are treated as negative covenants. In general, credit agreements are more strict than bond indentures, partly because it is easier to get a waiver on a credit agreement from a loan group.

The purpose and goal of negative covenants are:

A) Constrain the borrower – prohibit actions and activities detrimental to lenders

B) Accelerate the debt, if all else fails – give the lenders ability to terminate committments and accelerate maturity of loans

C) Must be realistic – what restrictions is the borrower capable of meeting in the ordinary course

D) Must be flexible – give the borrower some wiggle room to reflect ordinary ups and downs

E) Breaches must be material for lenders to act – immaterial breaches cannot be basis of material action by the lenders

Subsidiaries

The covenants in most credit agreements apply not only to the borrower but to the borrower and its subsidiaries, the theory being that the financial strength of the borrower is only as good as the strength of the entire group of companies of which the borrower is the parent.

The company and its restricted subsidiaries are subject to the covenants, even if the company is the only signatory to the indenture.

In a credit agreement with both restricted and unrestricted subsidiaries, the restricted subsidiaries are subject to all of the representations, covenants and defaults, while unrestricted subsidiaries are typically subject to none of these. However, unrestricted subsidiary earnings are not used in the financial covenant calculations. To be unrestricted, a subsidiary may not have debt or other liabilities guaranteed in any way by the borrower. Similarly, the unrestricted subsidiary may not have any outstanding debt or other liabilities that will be accelerated upon a default under the credit agreement.

Significant subsidiaries – any subsidiary that has 10 percent or more of the assets or 10 percent or more of the income of the borrower’s consolidated group. The insolvency of a subsidiary gives rise to an event of default only if the subsidiary is significant. This is so that lenders need not be concerned about events at the borrower’s subsidiary unless it is significant.

Affirmative covenants

These are things the borrower must do to remain in compliance with the agreement. These could include filing quarterly and annual statement filings within a certain amount of days after a quarter or year end. It could also include maintaining property , holding insurance, buying interest rate protection to guard against swings in interest rates, and making sure that the use of proceeds of the loan be used for the purposes it specified.

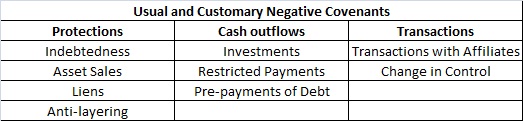

Negative covenants

Negative covenants tell the borrower what it may not do. When looking at these limitations, it is important to look for carve-outs that permit the issuer to get past the limitation. Negative covenants can be grouped into two major categories:

- Limitations on what the issuer can do

- Financial tests that the issuer must pass

Limitation on indebtedness

Purpose – prevents borrower from issuing excessive additional debt

Permitted exceptions – examples

1) Existing debt

2) Intra-company debt

3) Purchased M&A debt

4) Debt to be refinanced – new debt permitted to refinance or replace existing debt

5) Ratio debt basket (more frequent in bond indentures) – permits additional debt as long as it meets debt incurrance tests

6) True baskets – permits the borrower to issue additional, “undedicated” debt. Typically dollar capped.

Limitation on subsidiary debt

The limitation on subsidiary debt is relevant in the absence of upstream guarantees and is an important constraint on consolidation leverage and subordination. In Moody’s view, there should be no borrowing unless it is permitted under the debt incurrence ratio test.

Limitations on liens/negative pledge

Purpose- prohibits or limits debt/other obligations secured by collateral, which would improve other lenders prospects and recovery in default or insolvency

Permited exceptions – examples

1) Pari passu/junior; intercreditor agreements allows limited secured debt with equal or junior claim to same assets. Intercreditor agreement governs inter-relationship of competing claims in same collateral.

A negative pledge covenant prevents the issuer from raising secured debt unless it provides security “ratably”, thereby limiting subordination. Limitation on liens constrain a company’s ability to create secured debt ahead of the existing security. Carve-outs include 15% of net tangible assets or working capital, vendor financing, and bank debt.

Negative Negative Pledge – limits the ability of a borrower to enter into negative pledges with third parties. The main reason why the lending syndicate wants a negative negative pledge is to ensure that the borrower is free to grant security to the syndicate in the future without having to obtain consent from any third party. Since a borrower can be expected to be subject to many lien restrictions in the ordinary course of its business, a negative negative pledge covenant normally contemplates a long list of exclusions.

Limitations on asset sales

Purpose – limits risk to lenders when the borrower shrinks

Permitted exceptions – examples

1) Consolidation – goal is to get fair market value for assets sold and as much cash as possible

2) Application of proceeds – ideally term loans are prepaid out of asset sales proceeds

Restrictions on asset sales should limit the issuer’s ability to sell an asset without using the proceeds to reduce debt or re-invest in the remaining operations, explicitly fixed assets. For re-investments, this covenant could require the proceeds be in cash or marketable securities until an investment can be found. Issuers are usually required to find an investment within 12 months (tight) or 12 to 24 months (loose).

Typical conditions include

1) Cannot exceed $250m or 10% net tangible assets, whichever is greater

2) Assets to be sold at fair market value

3) 75% of proceeds in cash

4) Mandatory prepayments

5) Any sales above $20m needs to be aggregated into a total amount

6) Comply with financial covenants

Limitation on sale/leaseback

This restricts the issuer from selling assets and then leasing them back. Such a shift creates a debt burden in the form of leases, as well as increasing fixed charges and reducing the asset pool available to bondholders. Many sale/leaseback transactions occur when a company is in need of liquidity.

Limitation on dividends/payments (restricted payments)

Purpose – limits most problematic use of cash – payments OUT with little or no chance to recover

Permitted exceptions – examples

1) Overhead/tax payments to parent – dividends to holding company-type parent to fund the parent’s ordinary expenses, pay taxes, etc

2) Regular dividends/interest on sub debt – addresses reality of paying dividends on public equity and servicing public debt

3) Special dividends – allows a sponsor to cash out its investment. Typically, when included, the principle purpose of the financing

4) Management fees – compensates sponsor for services, without doing an “end run” around general dividend restrictions

A restricted payment covenant typically restricts an issuer’s ability to

- make distributions, whether in the form of cash, assets or securities

- repurchase equity or provide dividends to shareholders

- to redeem subordinated debt

The definition of a “restricted payment” should include all three of these payment and distribution categories. Such a covenant also constrains an issuer’s ability to make “restricted investments.” These are investments in “unrestricted subsidiaries” – that is, subsidiaries not subject to the indenture covenants (and thus not part of the indenture’s credit group) as well as other investments that are not permitted investments, such as joint ventures and minority investments.

It is not typical for even the most restrictive covenants to absolutely forbid dividends, nor is this desirable. For low growth, high cash flow companies, an absolute prohibition on dividends may be impractical because issuing dividends may become more rational than reinvestment.

Restricted payments covenants are typically crafted in two parts. The first is a general basket that usually builds as a percentage of consolidated net income of the issuer and its restricted subsidiaries. The second part of the covenant is a list of specific baskets for defined purposes and in specific amounts.

The general basket is designed to be a function of a company’s profitability over the entire period since issuance of the bonds. It is cumulative and may be used for distributions subject to the absence of any pending event of default on the bonds and compliance with financial covenants.

The general basket is the sum of a number of different components: one is 50% of consolidated net income minus 100% of consolidated net losses. Other typical components of the general basket are the following:

- equity contributions

- conversions of debt to common stock

- the value or amount of investments in an entity that had been previously designated as an unrestricted subsidiary, but that has been re-designated as a restricted subsidiary

- the amount received from dispositions of other restricted investments tha are not “permitted investments’.

Common specific baskets include:

- redemptions of subordinated debt out of proceeds from sale of equity

- employee stock purchases

- dividends.

Limitation on investments

Purpose – protects lenders against imprudent investments

Permitted exceptions – examples

1) Permitted acquisition – limits size, nature, financial impact and other characteristics/results of an acquisition. For example, pro-forma financials may have to meet a tougher standard, may have to be in the same line of business, may have to be in the US, etc

2) Build-up basket – rewards borrower for good operating results and othe rpositive events by permitting borrower to invest, spend, distribute cash. This is sometimes referred to as a “slush fund”. Borrowers would like the basket to be based on consolidated net income while lenders would like the basket to be based on excess cash flow.

This is the covenant that gets the most discretion and flexibility. Permitted acquisitions are heavily negotiated.

Limitations on pre-payments of debt

Purpose – middle ground between investments and restricted payments. Allows limited prepayments on debt below lenders. Balances excessive outflows of cash against reduction in debt service costs.

Permitted exceptions – examples

1) “Equal fo equal” or ‘junior for senior” – refinancing that does not improve the position of refinanced debt

2) Special financing – when included, often primary purpose od lenders loans. Akin to a special dividend

Restrictions on mergers/sales of all or most assets

Merger restrictions intend to limit an issuer’s ability to substantially merger or consolidate with another corporation or sell most of its assets. Currently, this covenant rarely offers significant protection because of large carve-outs and important exceptions. The prohibition usually does not apply if the surviving corporation assumes the debt and there is no immediate event of default. While the actual percentage that equals substantially all is subjective it has been addressed in case law and can be triggered at less than 90% and is likely to be more than 50%.

Limitations on transactions with affiliates

Purpose – protects lenders against “sweetheart” deals, which disproportionately benefits affiliates and disproportionately penalizes borrower (and therefore lenders)

Permitted exceptions – examples

1) Arm’s length – affiliates do not exploit their control over borrower

2) Board approval/fairness opinion – blessing from disinterested persons

Limitations on being acquired (change of control)

A change of control is designed to protect bondholders most directly from leveraged buyouts as well as from other situations where a change in ownership could damage credit quality. The covenant generally gives bondholders the opportunity to put their bonds back to the issuer upon a change of control at 100% or 101%.

Bond indentures usually allow this as long as there is no default, the acquirer is a US entity, and the survivor assumes all indentures.

Other common Limitations could include guarantees, capital expenditures, contingent obligations and several others.

Limitation on layering (anti-layering)

This clause prevents the isuer from layering debt between the senior and subordinated debt. It is only used in senior subordinate deals to ensure that subordinated debt occupies the second class slot (and not the third or fourth).

Financial covenants

Definitions of Debt and EBITDA will vary by indenture/credit agreement because these definitions are negotiated. For debt, the definition could be total debt, net debt, secured debt or another variation. EBITDA is typically Consolidated net income plus interest, taxes, depreciation and amortization but could include other add backs.

LBO sponsors often will have cure rights to put in cash that could make the company comply with financial covenants.

Incurrence test

Most often seen in bond indentures, an incurrence test is a one-time restriction. A debt covenant that is an incurrence test might state that a company is prohibited from borrowing or issuing debt securities if the ratio of debt to EBITDA exceeds 5.00 to 1. The most common are fixed charge coverage ratio and leverage ratio.

Within that constraint, the company can take on debt without limit. But if it borrows up to the maximum permitted amount and in subsequent fiscal periods EBITDA declines sharply, so that the new ratio is 20 to 1, it would not be in default; the covenant is tested only when new debt is take on and not continually.

The purpose of the ratio test is to allow the company to incur more debt as the credit improves.

Maintenance test

A maintenance covenant would mandate that the ratio of debt to EBITDA be maintained so that it never exceeds an agreed level. If EBITDA plummets the borrower would be in default regardless of whether this is the result of a voluntary action on its part.

There are three types of financial covenants.

- Date specific (net worth or current ratio covenant)

- Performance over one or more fiscal periods (fixed charge or interest coverage covenant)

- Hybrid of date specific and performance (debt ratio)

Date specific covenants are typically balance sheet related and therefore are not performance related. The other two are performance covenants that generally detect deteriorations in credit quality sooner than capital covenants because they are based on current performance ratios rather than the stock of past profits and net capital contributions.

Date specific covenants

Net worth

The excess of the borrower’s assets over its liabilities. More often, the definition is built up from paid in capital and retained earnings less treasury stock. The covenant prevents the borrower from paying a large dividend to its shareholders that has the effect of reducing its capital below the agreed number.

Tangible net worth

Measures only tangible assets – tangible liabilities. This ratio is more often used.

Leverage ratio

Ratio of total liabilities to tangible net worth. The objective is to test whether the borrower has sufficient equity capital to support the liabilities carried on the balance sheet. Although at one time the leverage ratio was popular, it is used less frequently today since most lenders believe a debt ratio covenant that measures debt to EBITDA is a more accurate predictor of future performance.

Current Ratio and Working Capital

The purpose is to ensure that the borrower has sufficient liquid assets to cover liabilities that will come due in the next 12 months. Current ratio =current assets/current liabilities. Working capital = current assets – current

liabilities. An agreement rarely has both covenants and the frequency of those covenants has declined considerably in recent years as lenders focus increasingly upon a borrower’s cash flow rather than assets.

Performance based financial covenants

Interest coverage ratio

(EBITDA/Interest expense) This ratio is designed to ensure that the borrower has sufficient available cash to pay interest on its outstanding debt. Interest expense is normally defined to include only cash interest ; pay in kind interest and capitalized interest charges are excluded. Also, interest expense reflects interest hedging.

Fixed Charges Coverage Ratio

(EBITDA/Debt Service + Cap ex + taxes + preferred dividends). The purpose is to test the ability of the borrower to generate sufficient cash during a period to service all of its non-operating cash needs during the period.

Hybrid financial covenants

Debt Ratio (Debt/EBITDA) Debt ratios measures the firm’s ability to repay debt.