A starting point for financial risk analysis look at the last 10 years (or at least the last 5) of financial statements for the compamy and look for trends includng the following:

Profitability trends: Is the company consistently profitable or are earnings cyclical

Working capital usage: Is the company working capital intensive? How has working capital changed over the years? Is working capital cyclical or seasonal?

Capital expenditures: How capital intensive is the business? What is maintenance capex vs performance based capex? Is capex lumpy or consistent?

Free cash flows: Does the company consistently generate free cash flow? Is there a big difference between operating income and operating cash flow?

These are just some of the questions credit analysts need to ask to assess the company’s financials. Depending on the company and industry, there are many more questions that need to asked and answered in order to understand the company’s risk.

Combined with industry and company analysis, historical financial analysis should allow the credit analyst to forecast future cash flows and asses the company’s ability to repay the bonds.

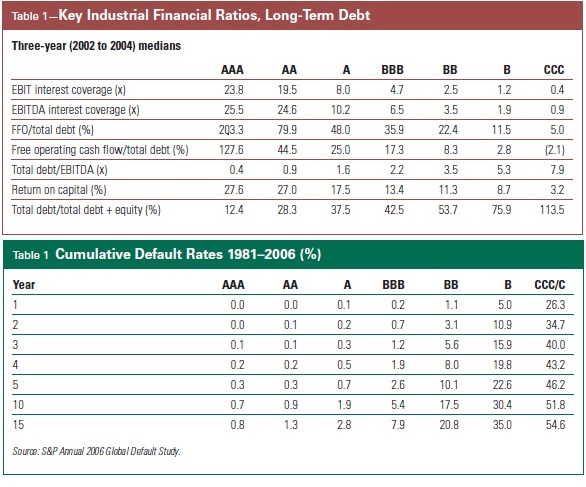

The following are some key financial ratios that credit analysts look at and where it places the company compared to the averages for each rating group. This is a useful guideline for the financial strength of the company since these ratios have been used for credit analysis over many years and have fairly good predictability for credit risk. Several of these ratios are also the basis of financial covenants used by most credit agreements and bond indentures.

The above chart only serves as a guideline for determining a company’s rating. For example, the average BB rated company has an EBITDA interest coverage ratio of 3.5 but there are many BB rated companies with higher or lower ratios. A company operating in a favorable industry and has a sustainable competitive advantage should have a higher rating than its ratios imply. Conversely, a company operating in an unfavorable industry should have a lower rating.

Other considerations

Beyond the simple financial ratio calculations and comparisons, it is important to focus on the balance sheet, profitability, cash generation and financial flexibility.

The balance sheet identifies the company’s financial obligations and the asset quality that support those obligations. Analyzing just the debt/equity structure is not sufficient to determine credit quality, but comparing all debt obligations, including those off the balance sheet, with the cash generation ability of the assets is vital.

Things to look for include post retirement and pension obligations, operating leases, securitized receivables, joint ventures and unconsolidated subsidiaries, and unusually large changes in working capital.

Profitability is a good measure of the viability, the volatility, the value, and the performance of the business, especially versus competitors. Ratios to consider include operating and net margins, returns on equity and total assets, and revenue and income growth. The actual ratios are important but the trends and forecasts of these ratios are even more important.

Cash generation is important because cash is used to pay financial obligations. Comparing the ability to generate cash with the need for cash, including its use in repaying obligations, is the most critical component of financial risk analysis.

The credit market is obsessed with EBITDA but a better approach is to look at the generation of free cash flow. EBITDA has some weaknesses that include

- Ignores changes in working capital and overstates cash flow in periods of working capital growth

- Does not consider the amount of required reinvestment

- Can be manipulated by changing accounting policies

Financial flexibility recognizes the entity’s ability to withstand fluctuations in business activity. Accessing cash and mitigating obligations is critical when the business environment shifts, especially for weak credits.

Analysts should consider situations where liquidity may be needed. These could include:

- A gradual deterioration in operating performance

- A dramatic setback in the business caused by a crisis in customer confidence

- A large adverse litigation judgment

- An unforeseen event that affects the entire industry

In these cases, the company may need access to liquidity that could come from the following:

- Cash and marketable securities

- Access to credit lines

- Cash from operations

- Asset sales

- Dividend cuts

- Capital spending cuts