Convertible Bond Basics

The bulk of material in this section is taken from the BAC primer on convertible bonds. The report does a great job of explaining difficult concepts so there’s no reason to reinvent the wheel.

A convertible security is traditionally defined as any investment instrument which is not currently common stock, but which can be converted into common stock at the holders’ option. This includes commonly known securities such as convertible bonds and preferreds but also extends to more exotic securities. Convertibles are hybrid securities that combine both equity and debt features. Through convertible securities, the investor participates in an equity price appreciation with a more limited downside risk, generally provided by the debt feature.

The debt feature of a convertible bond is derived from the convertible’s stated coupon and claim to principal. As such, its price is subject to changes in interest rates and credit worthiness of the issuer. The debt feature protects the convertible from a full decline in the price of the equity. The equity feature is derived through the call option, or warrant, embedded in the bond and enables the convertible bond to participate in an equity price appreciation. Accordingly, the value of the warrant is tied to factors affecting the underlying stock price. The value of the embedded option is significantly affected by the volatility of the underlying stock. As volatility rises, the potential appreciation in the stock price increases, resulting in a higher convertible value. Conversely, an increase in common stock dividends decreases the value of the convertible as it diminishes its relative value compared to the stock (the alternative investment). The longer the amount of time left on the warrant, the higher its value.

Convertibles exhibit hybrid behavior

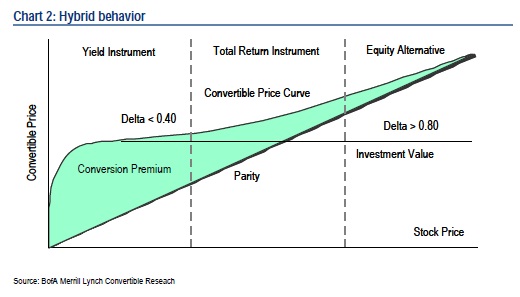

The two main determinants of a convertible’s behavior are its yield and its conversion premium. Generally, convertibles can be characterized into one of three categories: (1) yield instrument/straight debt alternatives, (2) total return instruments, or (3) equity alternatives. To illustrate the pricing dynamics of convertibles and these categories, we have constructed a theoretical price curve in Chart 2 below. The underlying common stock price is reflected along the horizontal axis, while the convertible’s value is depicted along the vertical axis.

Yield instrument/straight debt alternative – Convertibles in this category are characterized by relatively high yields and high conversion premiums. Given that the equity option is so far out of the money, the security behaves almost like a pure debt instrument with little regard given to the option value. Also called a “busted” convertible. This type of convertible is illustrated in the left-hand side of Chart 2 below.

Total return instrument – Convertibles in this category exhibit ideal characteristics of a convertible investment. Characterized by moderate yields/conversion premiums and a good level of equity sensitivity. This type of convertible is illustrated in middle section of Chart 2 below.

Equity alternative – Convertibles in this category behave very close to a pure equity investment. Characterized by lower yields/conversion premiums and a high degree of equity sensitivity. This type of convertible is illustrated in the right-hand side of Chart 2 below.

The investment value (i.e., straight bond value ignoring the conversion feature) is independent of the price of the underlying stock and hence appears as a flat line in the graph. It provides a theoretical floor below which the bond should not trade, given an unchanged interest rate and credit environment. In practice, the fixed income component is not an absolute floor, because it will shift in relation to the general level of interest rates and the company’s credit quality (like, the record credit spread widening in 2008). For very low values of equity, the convertible price drops with the equity because such low equity levels are associated with sharply worsening credit quality and a reduced probability of corporate survival.

As the underlying equity price increases, the parity (conversion value) of the bond also increases because parity is directly proportional to the price of the underlying equity. The “sweet spot” of convertible investing is the Total Return region. Here, the convertible offers a compelling risk/reward profile, enjoying greater participation with the equity on the upside than it suffers if the equity drops.

Provided the convertible bond is not about to be called by the issuer or the common does not out-yield the convertible, the convertible price lies above the greater of parity and straight bond value. A bondholder can always get parity by converting the bond to equity. In the event of a fall in the stock price, the convertible price is supported by the investment value of the bond, which is illustrated by the convertible price curve in Chart 2.