For convertible bonds, the meat of the indenture is in Article 14 Conversion of Notes. This states the terms of the conversion including when a bond can be converted.

For contingent conversion bonds (CoCos), these are typically the conditions:

- Bonds can be converted in the 3 month period prior to the maturity.

- If the common stock trades above 130% of the conversion price for a 20 day period prior to the end of the preceding quarter.

- If the convert trades at 98% or less of parity.

- If there is a fundamental change.

Conversion procedure; settlement upon conversion

Convertible bonds can be settled in several ways

- Stock settled – the company must give holders a number of shares equal to the conversion ratio upon conversion. For arbs, this is the most straight forward settlement. Upon conversion, the shares received will net off against the shorts shares on the position.

- Cash settled (instrument A) – The company will give holders cash equal to the conversion value of the convert usually based on the average conversion value over a set period of trading days. In this case, the arb has to buy back a fixed number of shares over the observation period. It is important for the arb to check with the back office regarding the exact observation period and whether if it is based on VWAP or closing price.

- Net share settled – The company could 1) settle in cash for up to par and the reminder in stock (instrument C) or 2) settle in either stock or cash (instrument B). In both of these cases, the final conversion will be based on the average over an observation period. The arb must determine the exact date when the observation period starts and ends.

Companies put in the net share settlement language into the indentures in 2004 to replace contingent convertibles following the accounting rule change pertaining to CoCos (in late 2004) that eliminated the EPS benefits of Cocos. Prior to 2004, FASB said that companies can ignore the impact of the conversion feature whenever the convertibility depends on some contingency.

Converts would not count in dilution unless the stock traded above the contingent level. Initially, net share settled converts allowed companies to only dilute EPS if the stock traded over the conversion price. The entire amount of the convert was classified as debt. In 2004, many companies provided sweeteners so holders would change CoCos to net share settle bonds.

However, effective 1/1/2009, convertibles with net share steeled features are subject to the new bifurcation accounting rule. FASB’s reasoning for changing net-share settled convert accounting was purportedly to accurately reflect the value of the underlying embedded convert equity option and capture the related dilution.

In MCP 3.25% 06/15/16, the issuer has a choice to settle in cash or stock

Subject to this Section 14.02, Section 14.03(b) and Section 14.07(a), upon conversion of any Note, the Company shall pay or deliver, as the case may be, to the converting Holder, in respect of each $1,000 principal amount of Notes being converted, cash (“Cash Settlement”), shares of Common Stock, together with cash, if applicable, in lieu of any fractional share of Common Stock in accordance with subsection (j) of this Section 14.02 (“Physical Settlement”) or a combination of cash and shares of Common Stock, together with cash, if applicable, in lieu of any fractional share of Common Stock in accordance with subsection (j) of this Section 14.02 (“Combination Settlement”), at its election, as set forth in this Section 14.02.

Some converts such as LRCX 0.5% 5/15/16 are fully cash settled. In a cash settlement, the company will pay a cash amount equal to the sum of the Daily Settlement Amounts for each of the 25 trading days during the observation period.

“Daily Settlement Amount,” for each of the 25 consecutive Trading Days during the Observation Period, shall consist of:

(a) cash in an amount equal to the lesser of (i) $40 and (ii) the Daily Conversion Value on such Trading Day; and

(b) if the Daily Conversion Value on such Trading Day exceeds $40, a number of shares of Common Stock equal to (i) the difference between the Daily Conversion Value and $40, divided by (ii) the Daily VWAP for such Trading Day.

“Observation Period” with respect to any Note surrendered for conversion means: (i) if the relevant Conversion Date occurs prior to February 15, 2016, the 25 consecutive Trading Day period beginning on, and including, the second Trading Day after such Conversion Date; and (ii) if the relevant Conversion Date occurs on or after February 15, 2016, the 25 consecutive Trading Days beginning on, and including, the 27th Scheduled Trading Day immediately preceding the Maturity Date.

Usually, there is language that says upon conversion, a holder shall not receive any separate cash payment for accrued and unpaid interest. This spells out whether you get the last coupon. Check Last Coupon Before Converting.

Make-whole conversion rate increase

In a takeout that is also a fundamental change, the issuer will often have a matrix that determine the number of additional shares the issuer will give to holders to compensate them for lost premium value in a takeout. Check Takeover Protection.

Adjustment of conversion rate for dividends and other events

Many convertible bonds are protected for either all dividends or dividends above a set threshold. In these cases, the conversion ratio is adjusted upward to compensate holders for a dividend payment on the stock. Check Dividend Protection.

Adjustment for spin-off

In a spin-off scenario, shareholders of the issuer ends up owning shares in both the issuer and the spun-off company. In most newer convert issues, holders would see a conversion ratio adjustment to compensate for the drop in the issuer’s stock price post-spin. In earlier issues, the convert would be convertible into a basket of stock in the issuer and stock of the spun-off company. This usually results in a volatility dampening effect since the two stocks will have a correlation of less than 1.

This language will be located under Article 14 Conversion under conversion ratio adjustment.

With respect to an adjustment pursuant to this Section 14.04(c) where there has been a payment of a dividend or other distribution on the Common Stock of shares of Capital Stock of any class or series, or similar equity interest, of or relating to a Subsidiary or other business unit of the Company, that are, or, when issued, will be, listed or admitted for trading on a U.S. national securities exchange (a “Spin-Off”), the Conversion Rate shall be increased based on the following formula:

CR’ = CR0 x (FMV0+MP0/MP0 )

where,

CR0 = the Conversion Rate in effect immediately prior to the end of the Valuation Period; CR’ = the Conversion Rate in effect immediately after the end of the Valuation Period; FMV0 = the average of the Last Reported Sale Prices of the Capital Stock or similar equity interest distributed to holders of the Common Stock applicable to one share of the Common Stock (determined by reference to the definition of Last Reported Sale Price as set forth in Section 1.01 as if references therein to Common Stock were to such Capital Stock or similar equity interest) over the first 10 consecutive Trading Day period after, and including, the Ex-Dividend Date of the Spin-Off (the “Valuation Period”); and MP0 = the average of the Last Reported Sale Prices of the Common Stock over the Valuation Period. The adjustment to the Conversion Rate under the preceding paragraph shall occur on the last Trading Day of the Valuation Period; provided that in respect of any conversion during the Valuation Period, references in the portion of this Section 14.04(c) related to Spin-Offs to 10 Trading Days shall be deemed to be replaced with such lesser number of Trading Days as have elapsed between the Ex-Dividend Date of such Spin-Off and the Conversion Date in determining the Conversion Rate.

Merger event

Most converitble bonds have some type of protection against a cash takeover. In a cash takeover, the premium for the convertible bond disappears as the cash takeover basically shortens the life of the embedded warrant. To protect investors, convertible bond indentures usually have some type of make-whole payment to holders in the event of a takeout. See more in Takeover Protection.

Incremental share factor

In 2003, a new structure appeared in converts called incremental share factor, which represents a number of additional shares received upon conversion, so long as the stock has passed through a defined threshold. In practice, it is as if some out-of the money warrants have been embedded within the convertible.

Traditionally, the number of shares received upon conversion of a convertible security is fixed at the time of issue and remains constant, independent of stock price. The incremental share factor adds additional shares to the conversion ratio as the stock price rises. So why would an issuer be willing to add shares to the conversion mechanism given a rising share price? We think the answer lies in issuers’ desire to sell stock at high conversion premiums, which in the deals priced to date have been significantly higher than in traditional convertible structures. The average premium on the five securities issued with incremental share factors has been 91%, significantly above the average premium of 43% for convertible bonds issued through April. Normally, a high coupon would be needed to issue a bond with a high conversion premium. With the conversion option so far out-of-the-money, the incremental share factor has been used to add value to the security, effectively reducing the coupon needed to price the structure.

Effectively, the conversion ratio as it relates to par has been decoupled. Traditionally, a convertible’s issue price, conversion ratio, and conversion price were interrelated. With the incremental share factor, that relationship breaks down and valuation of the option to convert takes on another dimension.

You will need to look at the defined terms to find the formulas for calculating the extra number of shares. The incremental share factor only comes into place when the stock is higher than the base conversion price.

Daily Conversion Rate Fraction” means, in respect of any conversion of Notes, a number of shares of Common Stock for each Trading Day during the relevant Cash Settlement Averaging Period determined as follows:

(a) if the Applicable Stock Price of the Common Stock on such Trading Day is less than or equal to the Base Conversion Price, the Daily Conversion Rate Fraction for such Trading Day shall be equal to 1/20th of the Base Conversion Rate; and

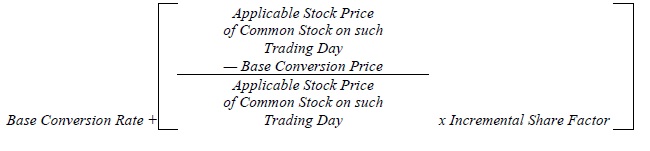

(b) if the Applicable Stock Price of the Common Stock on such Trading Day is greater than the Base Conversion Price, the Daily Conversion Rate Fraction for such Trading Day shall be equal to 1/20th of the following:

Notwithstanding the foregoing, if the Daily Conversion Rate Fraction for any Trading Day in the relevant Cash Settlement Averaging Period would otherwise be greater than the Daily Share Cap, the Daily Conversion Rate Fraction for such Trading Day shall be equal to the Daily Share Cap.

“Incremental Share Factor” means initially 8.9532 shares of Common Stock, subject to the same proportional adjustment as the Base Conversion Rate as set forth herein.

“Base Conversion Price” on any day means a dollar amount (initially, approximately $72.60) equal to $1,000 divided by the Base

Conversion Rate in effect on such day.“Base Conversion Rate” is initially 13.7741 shares of Common Stock, subject to adjustment as set forth herein.