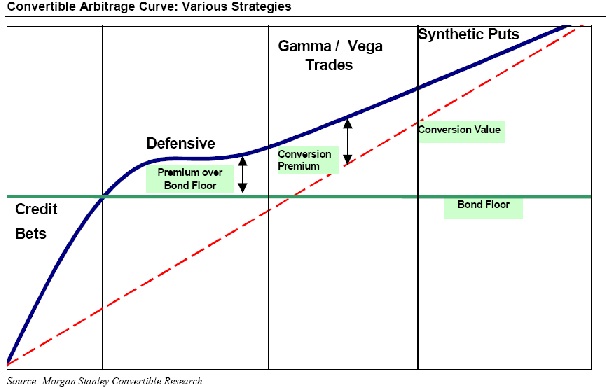

Convertible Arbitrage Trades

There are many types of convertible arbitrage trades but I will highlight the most common types here. Many of the concepts on this post were taken from Morgan Stanley’s research report, “Convertible Arbitrage: Bend Your Way to Profitability” from May 8, 2002.

- Synthetic puts

- Gamma trades

- Vega trades

- Defensive trades

- Credit trades

- Cash flow trades

Synethic Puts

Synthetic puts are highly equity sensitive convertibles that are in the money, trading with conversion premiums of less than 10%. In other words, these are convertibles with high delta, reasonable credit quality, and a solid bond floor.

Synthetic put strategies primarily are designed to profit from expansion of conversion premium (curvature) in case of a stock price decline. The secondary source of income is the static return, net of premium or theta (time value) decay. Static return is simply the net cash inflow generated by holding the position for the horizon, assuming no “trading” profits/losses. Positive cash inflow is earned from the convertible’s coupon / dividend and rebate from short common stock. Negative cash outflow, or cost of carry, occurs as a result of dividends paid on the short common stock and financing cost of the position. The difference (net cash inflow) is known as net position cash flow. Ideally, you want positive net position cash flow to pay for some of the premium of the convert.

Risks. The principal risk for this strategy is premium erosion or theta (time value) decay, in which the conversion premium does not hold or increase as the stock price goes down. Other risks associated with the “net position cost” are low coupon/dividend on the convertible and high levels of dividends on underlying stock.

Gamma/Vega trades

These are high gamma/high vega, middle-of-the-road convertibles with typically lower implied volatilities as compared to the high option/historical stock volatilites. In other words, the convertibles trade within the “sweet spot” of the trading curve. These are generally classified as convertibles trading with delta levels between 20% and 70%, with significant gamma/vega.

Gamma Trades

Opportunities for gamma trading arise by establishing a delta-neutral, or in some cases a biased, position involving a convertible security with reasonable credit quality, and simultaneous short sale of the underlying common stock. Due to the inherent volatility of underlying stock movements, this strategy requires careful monitoring by dynamically hedging the position, in other words continuously buying/selling shares of the underlying common stock.

Risks. This strategy is primarily based on undervaluation of the convertible on an implied-volatility basis as compared to the historical stock volatility. The key risk lies in the importance of determining an appropriate credit spread to arrive at a realizable level of implied volatility. Another risk stems from the transaction costs of continued hedging (due to the constant buying and selling of shares of underlying stock). As discussed above, the inherent volatility of the stock requires continual buying and selling of shares of underlying common stock in order to maintain delta neutrality of the position.

Vega Trades

Vega trades (or volatility trades) arise by establishing a long position in the convertible and selling appropriately matched call options on the underlying stocks that are trading at higher levels of implied volatility. Again, careful monitoring of the positions involving listed call options requires that the call option strike price and expiration is matched as close as possible to the convertible’s terms. Some stocks have longer-dated call options, called LEAPS (Long Term Equity Anticipation Securities), with expiration between nine months and three years, that offer higher

flexibility for convertible hedge investors.

Risks. The key risks to this strategy are the mismatches between the convertible’s call protection or maturity and call option expiration as well as between the convertible’s conversion price and call option strike price.

Defensive Trades

These are “out of the money” convertibles that have strong actual or implied investment grade/split rating. These securities have high bond floor, high conversion premiums, and low theoretical delta. In other words, these convertibles have low premium over bond floor, enabling investors to acquire the call option embedded in the convertible security at a very low price.

A common strategy is to be long the convertible and swap out the credit in the form of an asset swap (or hedge with CDS), to result in a low-cost call option. Another strategy is to be long the convertible security and short a very small number of shares of underlying stock, i.e., being on a very light hedge. The goal of such a strategy is to provide a bullish bias, in case the stock shows strong upward movement.

Risks. Key risks we see for defensive credit bets are: 1) Implied volatility on the long call position continues to decline. The credit spread of the long convertible position widens. 2) Credit risk can be quantified by omicron, which denotes the sensitivity of convertibles to increase in credit spreads. Convertible-hedge investors can mitigate the credit risk by either swapping out the credit in the form of an asset swap, or by entering into a default swap.

Since these convertibles tend to have very short maturities, they primarily have short-term interest rate and credit-risk exposure. However, those convertibles that have longer maturity, but high bond floor due to high rating, typically are susceptible to long-term interest rate risk, or “rho” risk. Investors can attempt to hedge out the interest-rate risk by using treasury futures, total-return swaps for a comparable corporate bond index, or interest-rate swaps.

Credit Sensitive Convertibles

These convertibles tend to trade deep out of the money and have an explicit or implied sub-investment grade rating. The key feature to note in these securities is that investment value (or bond floor) is difficult to determine, and it is possible that the issuer may not be able to meet its debt obligations. These securities have high conversion premiums and low theoretical delta. However, the actual delta for these securities tends to be much higher than theoretical delta. Continued weakness in the stock price tends to reduce the equity cushion available to the debt holder, causing the credit spread for the convertible to increase, resulting in the security behaving like stock. Consequently, these convertibles have a tendency to exhibit “negative gamma” i.e., declining at a rate faster than theoretical delta and in some cases faster than the underlying stock. Because credit-sensitive convertible securities lack firm bond floor, one way to access “delta” is to consider the securities as long-dated mandatory securities rather than as a convertible bond. While a convertible bond assumes a bond floor and suggests a “delta,” a long-dated mandatory has very little bond floor and has a high delta.

One of the arbitrage strategies that some investors employ to distressed situations is called “dollar hedging.” In this strategy, the long convertible position is matched dollar for dollar (i.e., equivalent dollar amount) by short stock position, resulting in substantial overhedging well beyond the theoretical delta. The excess short over and above the theoretical delta is intended as a source of credit protection. Another, less frequently employed method is to short a subordinated security (debt, preferred, etc.) of the issuer against the long convertible position (capital-structure arbitrage). If there are credit concerns surrounding the issuing company, it is highly likely that the credit spreads on the subordinated security of the company widen. By shorting the subordinated debt, the investor can offset the losses on the convertible with the profits on the short position on the straight debt. The key risk we see for this strategy is the high cost of carry for the short subordinated position from higher coupon of the short security.

Risks. Credit risk, which means that the credit spread may widen, tends to be the most important risk for investors in credit sensitive convertibles. Apart from credit risk, investors should be aware of the following risks:

Weak protection or lack of change-of-control put clause in case of a “change of control.” Most convertible bonds have a provision under which the holders can “put” the bonds back to the issuer for par (100%) in case of a “change of control” in the issuing company. The terms of this clause can be found in the convertible’s prospectus and vary for each security. Changes-of-control put clauses are typically triggered in case of acquisitions wherein a company is acquired for cash or non-stock consideration, instead of stock. Since these convertibles typically trade at very low prices, the change-of-control clause can cause very high returns for the investor. Due to the reasons explained above, weak protection or absence of a change-of-control put clause can be a risk to investors of credit-sensitive convertibles, whereas strong change-of-control protection could prevent the issuer from being taken over.

Expensive stock borrow. The short position is established by borrowing shares of underlying stock. When the company is in distress, the borrow ability of its shares tends to come under pressure, causing the borrowing cost to increase. Since most prime brokers tend to deduct the borrowing cost from the rebate offered for the short proceeds, the increase in borrowing cost hurts the short rebate. This decrease in short rebate negatively affects the profitability of the strategy.

Low convertible coupon income. Profitability for the overall strategy is also dependent on the coupon/dividend income earned on the convertible, especially in a rising interest rate environment. Credit-sensitive convertibles that offer a low coupon/dividend are particularly risk-prone, since the net position cost is high, which could reduce profits.

In summary, investment in these convertibles as credit bets requires careful evaluation of various factors. These include the issuing company’s ability to meet its debt obligations, and the coupon, maturity, issue size, and type of seniority or relative position of the convertible in the company’s capital structure. Other important considerations include the following:

- Funding cost of the long position,

- Leverage of the transaction, and

- Short-selling rules.

Cash flow trades

This strategy focuses on convertible securities with reasonable coupon or dividend income relative to the underlying common stock dividend and conversion premium. This strategy offers profitable trading alternatives where coupon or dividend earned and rebate received from the short position offset the premium decay over time, financing costs of the long convertible position and any dividends that may be payable on the short common stock.

For each position, calculate cash flows from:

- Coupon of the convertible bond

- Long financing costs

- Short rabate

- Dividend payout for short stock

In some cases, especially for deep in the money, long dated converts, the cash flow from the position more than offsets the premium of the convertible bond, which means you are getting paid to own a put option. These trades are rare but do exist and are more common today due to fewer convertible hedge funds in the market.

Risks. The key risk for this strategy can be due to possible large net position cost, arising from low coupon on the convertible, or high/increasing dividend and/or borrowing cost on the underlying stock. A rise in the level of interest rates also affects the profitability of the strategy as it increases the borrowing cost for the long position in the convertible security.