The ‘vanilla’ structure

As with other bonds‚ a convertible typically pays coupons and carries the promise of cash redemption at maturity. A convertible differs from straight debt in that the holder has the right to exchange the bond, usually at any time, for a predetermined number of the company’s ordinary shares, without any extra payment.

On conversion, the investor renounces title to the corporate bond and any future income streams from it in favour of ownership of the predetermined number of shares. A convertible with just this simple structure, with no complications, is sometimes referred to as ‘vanilla’.

Over time, issuers have incorporated other features into the vanilla convertible including

- Call features

- Put features

- Dividend protection

- Takeover protection

- Contingent convertibles (CoCo)

- Contingent payment convertibles (CoPa)

Check for topics listed under Convertible Indenture Analysis for more details about the twists and wrinkles that bankers have added to the vanilla convertible bond over the years.

Mandatory Convertibles

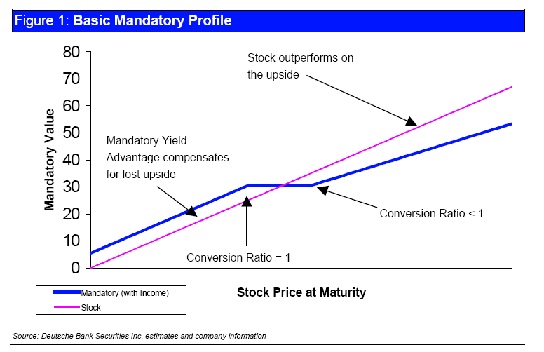

Mandatory convertibles are different from normal convertible bonds because at maturity they automatically convert into a given quantity of shares. Unlike standard convertibles, mandatory convertibles do not have a cash redemption at maturity and therefore provide little downside protection beyond the income stream. Mandatory convertibles can go by as many names as there are investment banks, but in general, the structures share the same basic characteristics. These include DECS, PRIDES, PEPS or ACES

Typical buyers of mandatory convertibles include both outright and arbitrage investors. Equity Income and Outright Convertible Funds are attracted to mandatory convertibles because of the higher yield offered relative to common stock and standard convertible bonds. The loss of upside is theoretically offset by the enhanced yield of the mandatory. Arbitrage investors are drawn to mandatories because they allow them to gain specific volatility exposure (long with stock near the upper strike and short when stock near the lower strike) that can offset other volatility positions in convertible bonds. Hedge funds also buy mandatory convertibles as ‘cash flow’ trades when the security is either deep in or deep out of the money. Finally, distressed investors buy ‘busted’ mandatory convertibles that have corporate bonds underlying the structure as a recovery value trade.

Original Issue Discount (OID) Convertibles

OID convertible bonds have below market (usually zero coupon) coupon levels and are offered at a steep discount to par (or face) value, and they gradually accrete to their face value at maturity. Yield to maturity is achieved by means of an issue price below final redemption value. Zero-coupon convertibles were popularized in the US in the mid-eighties by Merrill Lynch, which introduced the acronym LYONs (Liquid Yield Option Notes).

The traditional Lyons structure has a maturity of 15 to 20 years, but the bond will contain rolling puts, often every five years, and generally is callable by the issuer from the fifth year onwards. Consequently, it is highly probably that either the put or the call will be exercised in the fifth year, as under practically all circumstances, it would be optimal for either the issuer or the investor to exercise their option.

Therefore, investors can consider the first put and call date to be maturity. (Given the put, the bond cannot be worth less than this). When an investor converts a zero-coupon bond, the accreted interest is lost. Consequently, the effective conversion price will accrete over the life of the bond and the maturity payoff diagram shows that the return on the bond will remain constant unless the share price rises very significantly by maturity. The difference between the conversion price based on the issue price and the conversion price based on the final redemption price is the disadvantage (from an investor’s point of view) inherent in zeros, though investors should remember that this is taken into account in arbitrage valuations.

Structurally, zeros are the most bond-like and hence most defensive among all convertible categories while offering the least amount of equity sensitivity. During their traded life however, zeros, like cash coupon convertible bonds, acquire different degrees of equity sensitivity driven by the performance of the underlying common stock and the credit of the issuer.

Though the maturity of zeros is typically long (20 years), the existence of earlier puts effectively reduces that maturity horizon. This makes zeros less sensitive to interest rates because with a zeros’ price typically being closer to its bond floor, its downside support is likely to strengthen should short term rates decline and/or spreads contract.

There have been virtually no new pure OID convertibles issued since 2004.

Convertible preferred

Instead of the traditional convertible structure of a long bond with an embedded equity option, the convertible preferred is structured as a traditional preferred stock with an embedded option. In practice, convertible preferred stock behaves similarly to traditional convertible bonds with a long-term maturity.

Since preferred stock is lower in the capital structure in regards to claim on assets in the event of default, the credit risk is higher than all other debt holders. Because of the lower seniority and long term to maturity – if any, the convertible preferred will offer a higher yield than an equivalent convertible bond.

The convertible preferred market has traditionally been a mainstay in the convertible universe, representing about 15% to 30% of the outstanding market. In the past, most convertible preferred did not offer an obligation to pay principal value at any time in the future but many of the trust-structured convertible preferred now offer a maturity date and principal payment at maturity.