Trade idea:

Long 1m Tivo 4% converts due 3/15/16 on 53 delta, short 200 Jan 2014 12 strike call options at 90c. The converts trade at 108 vs 8.17. Using 500 credit spread, the converts imply 35 vol compared to 46 vol for the call options. Using 500 credit spread and 40 vol, the implied delta is 64. Combined with the short calls, the position delta would be 61.

I have a positive view on Tivo stock (closed at $8.20 on 6/8/12) because the company’s core business is turning around with a new focus on European cable companies and small-mid size US cable operators where Tivo is the exclusive DVR provider. There are also potential upside catalysts including lawsuit settlements with Verizon, Motorola, Time Warner and Cisco. To the downside, the credit is solid due to its large cash position ($567m cash) and the converts ($173m) being its only debt.

The reason for shorting Jan 14 calls as part of the trade is because Tivo converts would lose 4 points on a $12 cash takeout on a 53 delta. The call options would make back 1.8 points in that scenario to mitigate the cash takeout risk. Given that Tivo has a few lawsuits pending which could potentially bring in several hundred of millions, I do not see Tivo selling themselves unless for a large premium (greater than the $12 March 2012 high). A cash takeout at $13 would lose 0.7 points on the converts and 0.2 points on the short calls.

According to analysts, the stock was down over 30% in recent months due to 1) Worries about Europe which accounts for a significant amount of net adds (VMED in particular), 2) Fears that Apple TV would change the way set top boxes and DVRs are used and 3) the increased R&D spending. All three issues have the potential to be overreactions that can be fixed by delivering a couple of quarters of good results.

To the upside, the converts traded as high as 132 vs 12 in March 2012. On a 53 delta, the converts nuke to 126 for a 6 point gain before factoring in the call option loss of about 3 points.

To the downside, the converts would nuke to 97.7 at $6 compared to fair value of 97.3 using 700 spread and 45 vol. Plus, the short call options should make 1 point.

Equity and credit metrics

|

value $m |

per share |

||

| Cash and equivalents |

567 |

4.17 |

as of 4/30/12 |

| PV of AT&T payments |

140 |

1.03 |

$164m over 6 years |

| PV of DISH payments |

160 |

1.18 |

$200m over 6 years |

| Base business |

875 |

6.43 |

3.5x EV/revenues for core business |

| In line with comps rovi, imax, siri | |||

| Convertible bonds |

-173 |

-1.27 |

|

| Total valuation |

11.54 |

||

| Potential | |||

| VZ settlement |

190 |

1.40 |

based on AT&T settlement |

| Time Warner settlement |

400 |

2.94 |

based on DISH settlement |

| upside valuation |

15.88 |

||

|

|

|

Tivo stock closed 6/8/12 at $8.20, of which $2.90 was net cash and another $2.21 was in PV cash payments coming from Dish and AT&T for lawsuit settlements. This leaves the core business valued at $3.1 per share, or about $420m. I believe this implied core valuation is too low based on the turnaround in Tivo’s core business and the potential upside from future lawsuit settlements or adding new international cable relationships similar to VMED.

Tivo is not expected to be profitable in the next two years and will likely burn about $25m of cash per year over the next two years. However the losses are not a reflection of the business as Tivo spends about 40% of revenues on R&D (which should come down over time) and another 6% on litigation expenses.

From a credit perspective, Tivo’s credit is solid due to its large cash position, future cash payments from Dish and AT&T and low required cap ex needs ($5m per year). Its largest expenses are R&D and litigation, which can be controlled by the company if business were to decline. A large part of R&D is success-based spending to qualify new cable operators to make sure Tivo software works with the operator’s network.

I estimate Tivo as a B+ credit given its small size ($1B market cap), cash burn and technology risk, partly offset by its large cash position and low cap-ex business model. The average B+ 5 year credit spread is 620. Therefore, using 500 for 3.75 year paper is reasonable.

Similar to many software companies, Tivo needs to maintain a strong balance sheet in order to show customers that the company has staying power and is financially strong. Hence, I believe Tivo will keep its cash position high and not do anything drastic with the cash. No one wants be tied into technology of a company that can go bankrupt.

Business description

Tivo was founded in 1997 to offer its patented DVR technology to set-top boxes through the retail channel. Tivo had success early on as customers who wanted DVR technology had to buy the Tivo device. However, the MSOs (Multi-System Operators including cable, satellite, telecom service providers) created their own DVR software with work-arounds on the Tivo patent, which limited Tivo’s market share.

In the last 2 years, Tivo shifted its strategy from selling Tivo branded DVRs to selling software to be used by MSOs on any set-top box. Tivo has also aggressively and successfully pursued lawsuits against cable operators who develop their own work-around DVR software, claiming that the software infringes on the company’s patents.

Tivo generates revenues in three main ways:

1) Tivo sells branded set-top box/DVRs through retailers

2) Sell Tivo software to TV service providers (Cable and satellite operators)

3) License revenue from non-Tivo DVRs used by TV service providers

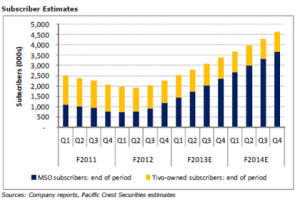

After a steady decline in subscribers, Tivo reached an inflection point in FY12 Q2 (July 2011) and has begun growing customers for the past three quarters due to the ramp by new MSOs led by VMED.

Tivo branded DVRs

Customers can buy Tivo DVRs at best buy and other stores for $150 with a 1 year commitment at $14.95 per month or $499 for a lifetime subscription. As of 4/30/12, Tivo had 1.1m subscribers but this number has been steadily declining (-29k subs in April 2012 quarter). Tivo loses about $200 per DVR on the hardware sale.

Tivo software to MSOs

Tivo’s distribution relationships are either 1) primary exclusive distribution partnerships where Tivo is the sole DVR offering by the MSO or 2) optional distribution partnership where Tivo is offered as a premium substitute for an existing MSO DVR. In both cases, Tivo receives a monthly recurring royalty payment (about $1 per sub per month) from the MSO based on the number of subscribers. As of 4/30/12, Tivo had 1.4m MSO-driven subs. Tivo added 235k subs in the April 2012 quarter.

Operators with primary exclusive distributions with Tivo total over 10m video subscribers including RCN (400,000 total subscribers), VMED (UK) (3.8m total subs), Suddenlink (1.3m total subs), Charter (4.1m total subs), and ONO (Spain)(1m total subs). VMED was the first to roll out Tivo DVRs and now has 680,000 Tivo subscribers (18% penetration). The Tivo relationship has helped VMED gain subscribers against competitors, which could gain attention across Europe. Unlike the US where operators develop their own DVR software, European operators have not shown much interest in developing their own software. Tivo’s other relationships (Charter, RCN, ONO) have recently begun to ramp with the rate of adoption remained to be seen.

Optional distribution partnerships exist with Cox (6m total subs), Comcast (22m subs), and DirectTV (19.8m subs).

Licensing revenues

In April 2011, Tivo won a lawsuit against DISH claiming that the latter’s DVR technology infringed on Tivo’s patents, leading to a settlement where DISH agreed to pay $500m to Tivo. Tivo received $175.7m upfront and will receive the remaining $321.4m to be collected as future license royalties in equal installments through 2017. In January 2012, AT&T settled with Tivo by agreeing to pay $51m upfront and at least $164m in installment payments through 2018. The amount could increase if AT&T adds more subscribers.

Tivo has a pending court case against Verizon scheduled for October 2012 but given that this case is similar to AT&T, there could be a settlement before the trial.

Tivo also has lawsuits against Motorola, Time Warner and Cisco.

Tivo’s DVR patents expire between 2018 and 2020.