Trade idea Arbitrage: ZINC

Horsehead Holding (ZINC) is the largest producer of zinc products in the US and the largest recycler of EAF dust in North America. It is an integrated producer using recycled zinc feedstock and low-cost recycled electric arc furnace (EAF) dust to produce its zinc products. The company diversified into nickel recycling when it acquired International Metals Reclamations Company (INMETCO) in December 2009 for $39m. In November 2011, Zinc acquired Zochem, a Canadian zinc oxide producer for $15m. Current operations include seven facilities across four states and Canada. No customer accounts for more than 10% of revenues.

Convert Analysis

ZINC 3.8% converts are offered at 100.25 vs. 10.93. Using 850 credit, implied vol. is 33.6 compared to options vol. in the high 30s/low 40s. 100day realized vol. is 32 and has been steadily declining to reflect the improving credit and lower risk of the new facility that is scheduled to come on-line in July 2013. I am positive on the stock and credit with targets of $14 for the stock and 700 for the credit, driven by production in the new facility expected to begin in July 2013 that should contribute $100m EBITDA on an annual basis. I would like to own 4m on a 57 delta (5 deltas light).

At $14, the converts nuke to 111.9, compared to fair value of 115.9 using 700 credit and 32 vol.

Borrow is full.

Cash takeout is flat at $14 and 57 delta.

Stock analysis

My price target is $14 based on 5.5x 2014 EBITDA of $150m (post new plant completion), which would bring it closer to its peer group average of 6.1x. The new plant is 70% done so management should have a good grasp of the progress of completion.

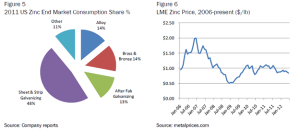

Given the impending zinc mine closures, zinc fundamentals are improving and prices are trending upwards. About 50% of zinc demand is related to steel demand. Even without price increases, ZINC should be able to grow earnings with the new plant, cost improvements and byproduct credits. The company also has put options (0.85c/lb) through 1Q14 as downside protection.

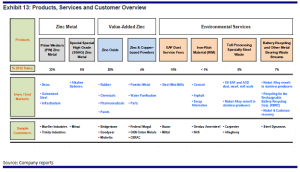

Horsehead’s product segments

New zinc plant

ZINC is constructing a new zinc plant (slated for operational start-up in 3Q13) that should drive down the company’s cost structure dramatically. Once operational and fully ramped, the new plant should permanently reduce the cash breakeven point from 0.65/lb to 0.4-0.45/lb vs. low-cost mined zinc that carries breakeven costs at 0.80/lb. This would make ZINC one of the lowest cost producers of zinc products in the world.

The new plant focuses on higher grade, higher margin zinc that offers a large market opportunity. Currently, most of Zinc’s metal is the lowest grade called Prime Western (PW) zinc that sells at a lower premium because it is not suitable for continuously galvanized products such as steel used in automobiles and appliances. The new plant will focus on special high grade (DHG) and continuous galvanized grade (CGG) zinc, which has lower lead content and sells at a higher premium ($50-$60/ton over PW metal). The CGG market is 10x the PW market. The new facility is expected to generate $100m EBITDA per year.

ZINC has 65-70% market share of available EAF dust (byproduct of carbon steel galvanizing process), which acts as an effective barrier to entry against other metals recyclers gaining a market foothold. Most of ZINC’s EAF dust supply is from long term contracts (10+ years) with leading mini-mills such as Nucor and Steel Dynamics.

Zinc market

Zinc is produced via conventional mining and Electric Arc Furnace (EAF) dust recycling. EAF dust is classified as hazardous waste and is produced from steel and mini mills such as Nucor and Steel Dynamics. This dust, which contains 20% zinc, is collected by Horsehead and other competing EAF dust removal services from steel mills. About 50% of all zinc slabs in the US are produced by recycling EAF dust. Zinc is levered to steel demand as roughly 50% of all domestic zinc consumption is as an anti-corrosion coating in the production of galvanized steel. Zinc is also alloyed with copper to make brass or bronze. Other uses include alkaline batteries, rubber, paint and pharmaceuticals. The US market currently consumes about 1m tons of refined zinc. About 70% of supply comes from imports (Canada, Mexico, Peru).

Credit analysis

ZINC has secured debt that is rated B2/B-and trading at about 700bps credit spread. The converts are not rated. As of 12/31/12, the company had $244m in cash, $75m in access to the revolver, and $30m of operating cash flow through 2013 to cover the remaining $200m needed to complete the new plant. The company is highly levered at 7.1x so the bet here is on the credit and the completion of the new plant.

Cash = $244m

Revolver ($75m, 09/2016) = undrawn

10.5% senior secured notes due 6/2017 = $175m (rated B2/B-)

3.8% convertible notes (7/2017) = $100m

Total debt = $285m

Market cap – $481m

EBITDA 2012 = 40m

EBITDA 2013 = $52m

EBITDA 2014 = $132m

Debt/EBITDA (2012) = 7.1x

Debt/EBITDA (2013) = 5.5x

Debt/EBITDA (2014) = 2.2x

The secured notes trade at 108 (spread of about 700). I would use 850 spread assumption for the converts.

Remaining capex to complete the new zinc plant is $210m