Trade idea Arbitrage: WNC

Wabash (WNC) is a manufacturer of truck trailers for the North American market. The company reports in three segments: 1) Commercial trailer products (71% of sales), 2) Diversified products (26%) and 3) Retail (7%).

Convert Analysis

WNC 3.375% converts are offered at 116.25 vs. 9.66. Using 500 credit, implied vol. is 38.6, compared to 50 day vol. of 45 and 100 day vol. of 42. Options are not very liquid but imply mid-40s vol. Delta is 66 using 500 and 40. I would like to own these bonds at 56 delta (10 deltas light) due to my thesis that the stock will go up with a price target of $14.

We currently own 1.2% position in the outright book.

At $14, the converts nuke to 137, compared to fair value of 143 using 400 credit 35 vol.

Borrow is full.

Cash takeout is flat at $14 and 56 delta.

Stock analysis

My price target is $14 based on 8x 2013 estimated EBITDA of $175m. At similar points of prior cycles, WNC has traded between 8x- 10x forward EBITDA. I believe that we will see a strong trailer replacement cycle over the next two to three years and WNC’s recent acquisitions in the tank trailer space should significantly improve margins and reduce earnings volatility.

WNC reported solid earnings on 2/6/13. However, the report fell short of heightened expectations going into earnings. In the following two days, the stock sold off 11%. I believe the sell-off is an opportunity to buy the converts on a light delta. The truck trailer cycle should be good this year but there will be hiccups along the way. This provides good trading opportunities and volatility.

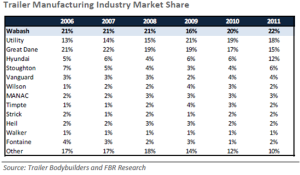

WNC is the leader in trailer manufacturing with about 22% market share. Going forward, the company is focusing on profitability even at the expense of losing some share. Early indications are that pricing has held up well, especially in the more technologically sophisticated product offerings such as liquid tank trailers, added through the Walker acquisition, which are less commoditized, higher margin businesses.

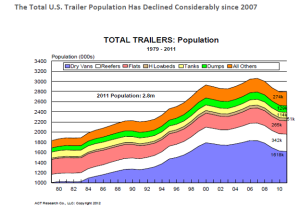

There is significant pent-up demand for truck trailers caused by deferred replacement spending during the recession. Additionally, in the up cycle 2004-2006, fleets focused their capex on tractors rather than trailers to pre-buy ahead of the 2007 EPA emissions standards. After 2007, fleets were to re-focus on buying trailers but the recession cut that cycle short. As a result, the total trailer population shrunk from a peak of 3.1 million in 2007 to 2.8 million in 2011. The average trailer age increased to an all time high of 8.5 years in 2011.

Credit analysis

WNC is rated B1. The company does not have any debt maturing until the converts in 2018 and has ample liquidity with $39m cash and $150 undrawn revolver. WNC also generates significant free cash flow of over $100m per year. I think a fair spread assumption is 500.

Cash = 39m

Revolver 5/8/17 = 0 drawn; $150m available

Term Loan 5/8/19 = $300m

3.375% converts 2018

Total debt = $450m

Market cap = $668m

Enterprise Value = $1.079b

2012 EBITDA = $120m; capex $15m

Secured debt/EBITDA = 2.5x (term loan covenant <4.5x)

Total debt/EBITDA = 3.75x

Interest coverage = 5.7x (term loan covenant > 2.0x)