In the case of Dynegy, the lack of restrictive covenants led to the company changing its corporate structure to take assets away from the unsecured bondholders of DHI. DYN

On November 7, 2011, Dynegy reached a restructuring support agreement (RSA) with a group of bondholders that combined hold $1.4B of DHI’s total $3.4B of unsecured bonds. In conjunction, Dynegy placed certain of its subsidiaries including DHI and DYN Northeast Power Generation into bankruptcy. Dynegy’s parent and holding company was not part of the bankruptcy filings. The RSA, if approved by two-thirds of the amount of unsecured bonds outstanding and one-half of voting claimants would entitle DHI unsecured bond holders and owners of leasehold interests in Dynegy’s Roseton and Danskammer assets:

$400M cash

$1.0B , 7 year 11% secured notes at Dynegy Inc.

$2.1B convertible notes at Dynegy Inc. These notes have a PIK (pad-in-kind) feature embedded in them and accrue interest at 4% through 12/31//2013. 8% in 2014 and at 12%, thereafter. These notes are mandatorily converted into 97% of DYN outstanding shares at 12/31/2015. They may be retired at up to a 7% discount or for $1.95 billion.

Specifically to the holders of the subordinate 8.316%: The plan contemplates, a 25 cent on the dollar treatment in lieu of contractual subordination ($200M outstanding for a total claim consideration of $50M)

Distressed Debt Website Analysis:

Throughout the day today, there were many many markets being made on both the cash bonds and the triggered CDS of Dynegy. It felt like the 8.375% senior unsecured notes due May 1, 2016 were the most liquid cash bonds of the day which went out 75.75-76.25 Here is a chart:

Quick note: This bond will trade slightly higher than the rest of the complex due to the larger claim as a result of accrued interest.

As you can see, bond prices rallied very hard today and over the past two-three weeks.

The question then becomes: What is this thing worth. It really hinges on three things:

- What you believe the price of the new 11% Secured Notes will trade to

- What you believe the price of the new Convert notes will trade to

- And to a lesser extent – the probability / chance that Roseton-Danskhammer rejection claims are significantly more than $300M and the whole plan has to be re-worked

Stepping back a bit: There is $3,570M face value of bonds outstanding at Dynegy including the aforementioned sub notes. I then gross up this value based on accrued pre-petition interest. For instance, the 8.375% notes have $1,046,834,000 outstanding. Each bond has about 4.4 points of accrued interest meaning the total claim is $1,046,834,000 * 1.044 ~ $1,093,000,000.

Each bond is grossed up by the accrued interest. Then I adjust the sub notes to 25% of claim as discussed in the restructuring support plan agreement. I then assume $300M of rejection claims from Roseton-Danskhammer.

This is somewhat important because according to the restructuring support agreement:

“If the aggregate claims arising from the rejection of the Roseton / Danskammer leases are allowed by the bankruptcy court in an amount that is less than $300 million, the aggregate principal amount of New Secured Notes shall be reduced by an amount to be agreed for every dollar such claims are less than $300 million. If the allowed claims exceed $300 million and the condition to consummation of the chapter 11 plan requiring such claims to be capped at $300 million is waived as set forth below, the aggregate principal amount of New Secured Notes shall be increased by an amount to be agreed for every dollar such claims exceed $300 million. The adjustment amount to be agreed for increases in the New Secured Notes shall be the same as the amount for decreases in the New Secured Notes.”

Bringing this all together, I see approximately $3,850M claims. Of this, each bond will have a different percentage of % claim based on the size of the bond and its accrued interest. Our 8.375% notes for instance have 28.3% of the claims.

We must then apply this 28.3% to the value of the package being received:

- 28.3% * $400M of cash = $113.2M

- 28.3% * $1 Billion of Notes = $280.3M * Assumed Trading Price of Bonds. I actually am more bullish on this piece of paper than the market given how much equity I think there is at GasCo and CoalCo (which secures the new notes). I assume that they trade at par+ (whereas many people are saying in the low to mid 90s). So $280.3 * 100 = $280.3

- 28.3% * $2.1 Billion of Convertible PIK Notes = $594.3M * Assumed Trading Price of Bonds. This is where things get real messy, and truly believe the swing factor here given the size and uncertainty of what will happen with this security.

With the market trading price of the existing 8.375% senior note at 76, the market is implying (assuming par on the secured notes), that the convert will trade to ~74 cents on the dollar. (To check math: $113.2 + $280.3 + (74% * $594.3) = $833.3 /$1,093 = ~76.

To me, that feels right (mostly based on the PIK, and subordinated nature of the security), but I think there is upside there for 2.5 reasons:

- Aforementioned equity value of GasCo and CoalCo flows through to the Converts after deducting for 11% Notes. I would expect an IPO of one or both entities after litigation is resolved.

- The incentive factor here: If the converts are not called prior to 12/31/2015, they are then convertible into 97% of DYN’s equity. It is imperative for equity holders to deal with this security prior to that. Of course, when you got Carl Icahn calling the shots, you never know what you are going to get as a bond holder

And reason 2.5 -> If you are bullish on the power market, this is a very (VERY) levered way to play recoveries in the power market (where demand, in theory, eventually should increase in a time when no new supply is coming to the market.

With that said, at today’s prices there is not enough pessimism priced into the bonds to get me overly excited. I would play in small size and then wait for some sort of scare on the litigation front or the power markets to add to my position. This will be a fascinating bankruptcy to follow after what happened with Mirant 5 years ago. We will keep you updated as the trial (s) proceed.

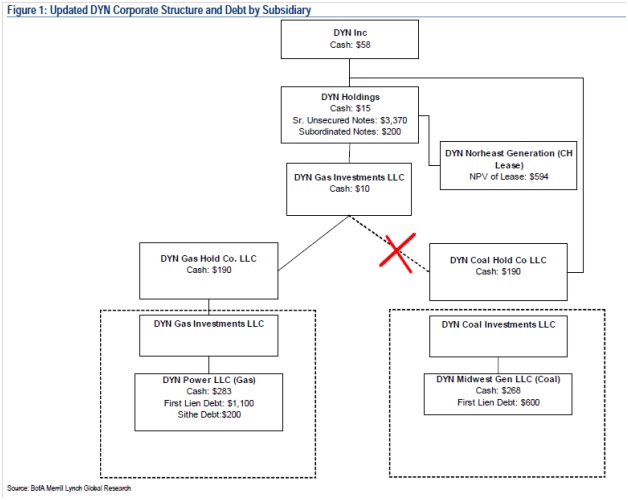

In September 2011, Dynegy completed its second restructuring step by transferring Dynegy Midwest Generation (CoalCo) out from under DHI to Dynegy Inc. Dynegy’s board valued the CoalCo equity stake at $1.25B after taking into account all debt obligations of CoalCo, including CoalCo’s new $600m, five year senior secured term facility. Dynegy offered to exchange for $1.25B unsecured notes of DHI for new Dynegy 10% secured notes and cash. Bond holders rejected the exchange.

The weak covenants of the DHI unsecured notes contain no protection against the transfer of CoalCo. They have an investment grade style covenant package with no upstream guarantees. The only recourse bondholders have is to argue for fraudulent conveyance but lost their case.

In July 2011, Dynegy announced plans to refinance its existing credit facilities and reorganize its assets into a GasCO subsidiary and a CoalCo subsidiary, while leaving the Roseton-Banskammer lease structure at DHI. BAC thinks DYN will take a page from TXU’s 2010 playbook: implementing negotiated and offered discount debt exchanges to squeeze DHI’s outstanding bonds into a smaller but more sustainable capital structure, using multiple layers in the capital structure and corporate structure and other tactics to transfer value to shareholders from bond holders.

In December 2010, Icahn makes a $5.5 cash offer that was ultimately unsuccessful.

In November 2010, Blackstone raised its offer to $5.00 cash per share but was still unsuccessful.

On August 10, 2010, Blackstone agreed to acquire Dynegy for $4.5 per share, or $540m; including outstanding debt, the transaction has a total value of $4.7B. As part of the deal, Blackstone will sell four Dynegy natural gas fired power plants for $1.36B, which essentially gives Blackstone a free asset, cash plus a free call option on future power prices and dark spreads. BAC thinks the remaining assets have a interest coverage ratio of only 1.0x.

The reason Blackstone could do this is because of weak bond covenants that do not prevent such a sale.